Houston Texans followers flick through the NRG fan store in seek for the proper swag forward of the season because the crew unveils their new uniform...

LOS ANGELES (AP) — A photographer who labored for Megan Thee Stallion mentioned in a lawsuit filed Tuesday that he was pressured to look at her...

Jordan Johnson/NBAE by way of Getty Photos The Phoenix Suns face an 0-2 gap of their first-round collection in opposition to the Minnesota Timberwolves, and it...

Vincent Trocheck and Mika Zibanejad every had a aim and an help and the Presidents’ Trophy-winning New York Rangers held on to beat the Washington Capitals...

The Biden administration issued last guidelines Wednesday to require airways to robotically subject money refunds for issues like delayed flights and to higher disclose charges for...

The Rangers nonetheless had an opportunity when a crucial face-off was held deep of their zone. Initially, New York middle Buddy O’Connor was to take the...

CHICAGO (AP) — The “rat gap” is gone. A Chicago sidewalk landmark some residents affectionately known as the “rat gap” was eliminated Wednesday after metropolis officers...

At this time, the Federal Commerce Fee issued a last rule to advertise competitors by banning noncompetes nationwide, defending the basic freedom of staff to alter...

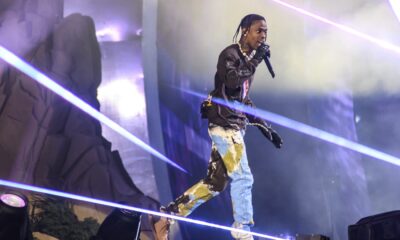

HOUSTON (AP) — A decide has declined to dismiss tons of of lawsuits filed towards rap star Travis Scott over his function within the lethal 2021...

NEW YORK (AP) — A fired minor league umpire sued Main League Baseball on Wednesday, claiming he was sexually harassed by a feminine umpire and discriminated...