Following the newest Halving, Bitcoin’s inflation charge has formally develop into decrease than Gold’s, making BTC the scarcest asset in historical past.

Bitcoin Halving Outcomes In Inflation Fee Dropping To Simply 0.83%

In its newest weekly report, the on-chain analytics agency Glassnode mentioned the impression of the newest Halving on cryptocurrency. Halving is a periodic occasion on the Bitcoin blockchain during which its block rewards are completely reduce in half.

These occasions happen roughly each 4 years, with the newest one occurring only a few days in the past. This was the asset’s fourth Halving, bringing its block rewards down to three.125 BTC from 6.25 BTC.

The block rewards miners obtain for fixing blocks on the community are the one technique of minting extra cryptocurrency. A function of the community is that regardless of the mining-related situations current on the time, these rewards are given out at a near-constant charge.

That is potential as a result of the idea of “Problem” is coded into the chain, by means of which the community adjusts how exhausting miners discover it to mine on the blockchain.

When the miners add extra computing energy, they develop into sooner at what they do and produce blocks sooner. Because the community desires block rewards to be given out at a relentless charge, it will increase the Problem within the subsequent scheduled adjustment, thus bringing the miners again right down to the specified tempo.

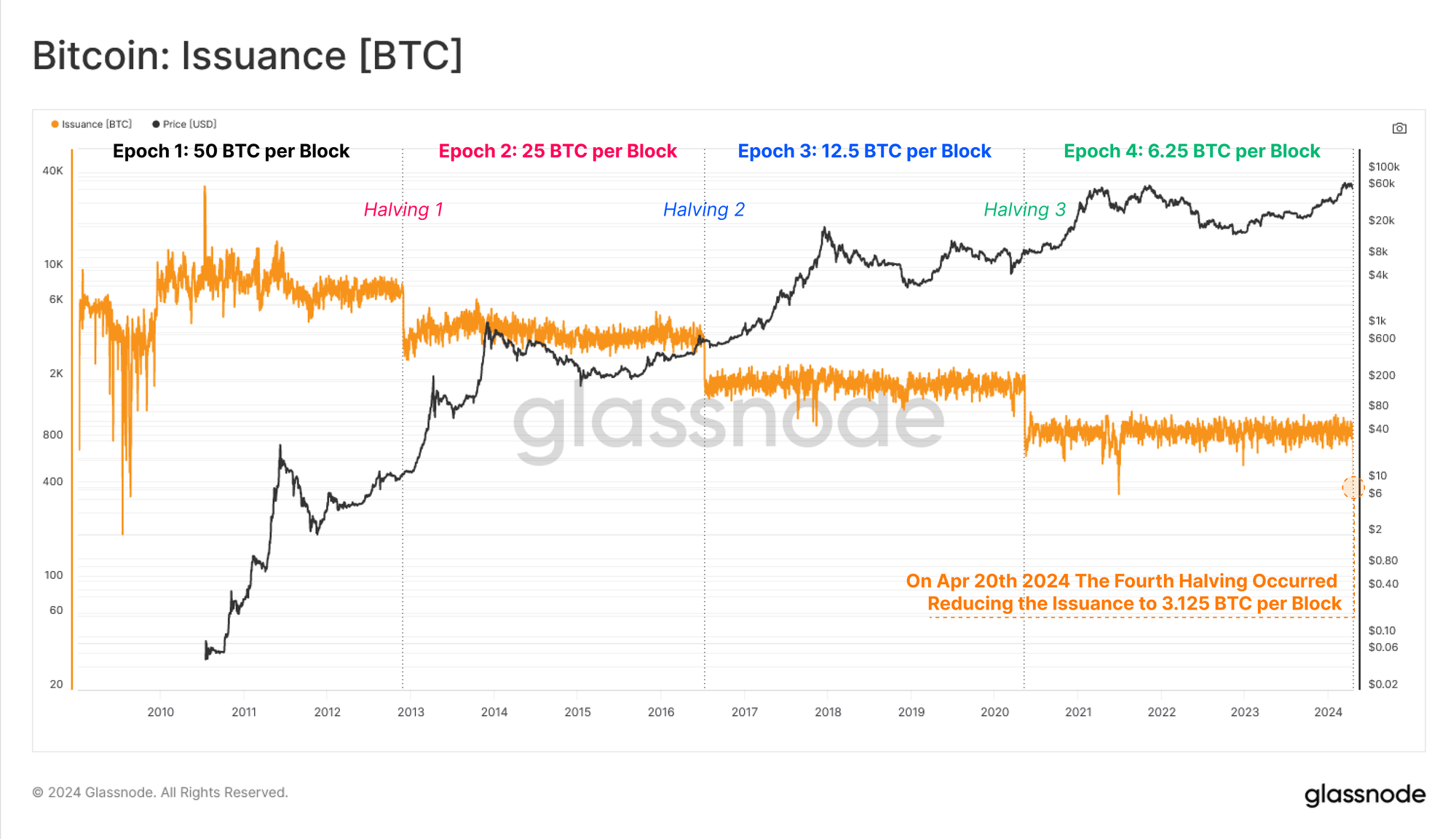

A consequence of the Problem is that the Bitcoin provide grows virtually consistently between Halving occasions. The chart under exhibits how the Issuance on the community (that’s, the quantity that miners produce day by day) has modified over the asset’s historical past.

The info for the Issuance over every BTC epoch | Supply: Glassnode's The Week Onchain - Week 17, 2024

Because the Issuance is kind of fixed between Halvings, the asset’s inflation charge additionally stays fixed inside these home windows. Equally, the inflation charge additionally halves alongside the Issuance throughout Halving occasions.

Naturally, with the newest Halving, too, this setup has remained true, as Bitcoin has seen its inflation charge being shaved off as soon as once more. Within the final epoch, BTC’s annualized inflation charge was round 1.7%; on this new epoch, it’s now right down to 0.85%.

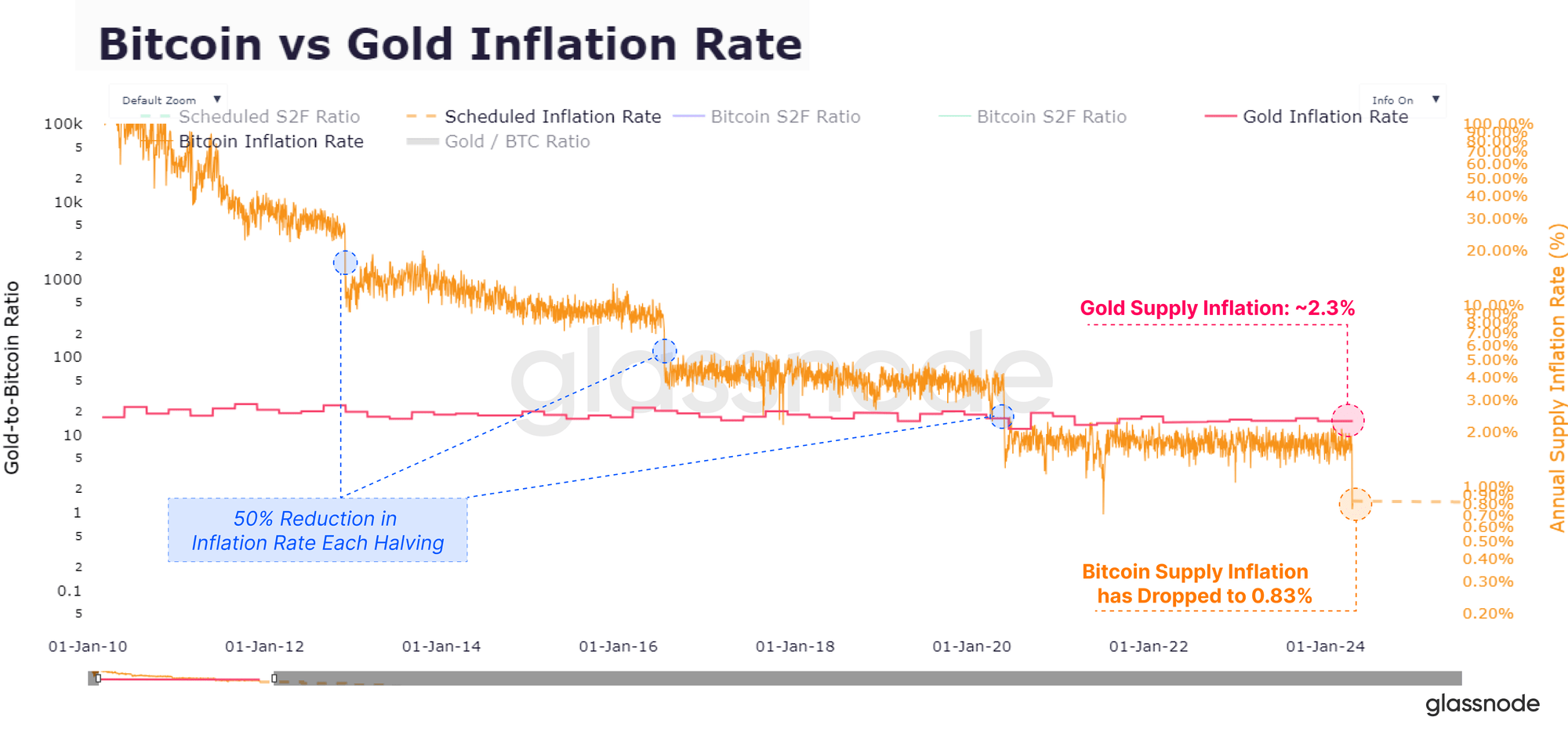

Due to this, Bitcoin has been in a position to obtain a brand new milestone by way of its comparability with Gold, because the report reads, “for the primary time in historical past, Bitcoin’s steady-state issuance charge (0.83%) turns into decrease than Gold (~2.3%), marking a historic handover within the title of scarcest asset.”

Under is a chart that exhibits how Bitcoin’s inflation charge has in contrast in opposition to that of the dear metallic over time.

The worth of the metric for BTC appears to have pulled away from Gold not too long ago | Supply: Glassnode's The Week Onchain - Week 17, 2024

BTC Value

Bitcoin had managed to recuperate over the previous couple of days, however the asset has slipped off previously day, with its worth retracing again to $64,700.

Seems like the value of the coin has plummeted over the previous day | Supply: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, Glassnode.com, chart from TradingView.com