The Bitcoin worth has skilled heightened volatility over the previous week. After recovering from a low of $56,500, the biggest cryptocurrency available in the market surged to $65,500 inside 4 days. Nonetheless, it has since retraced a few of its positive factors and is at the moment testing the $61,000 assist degree.

Regardless of this volatility and the absence of robust bullish momentum, enterprise capital agency Pantera Capital stays optimistic about the way forward for BTC’s worth, citing the latest Halving occasion as a major issue.

Pantera Capital Tasks $117,000 Worth Goal By 2025

In a latest investor letter, Pantera Capital revealed its Bitcoin Halving rallies mannequin, which predicts a bottoming out of the BTC worth adopted by an increase by way of the Halving rally.

Based mostly on the common period of earlier rallies, the agency forecasts that BTC’s worth will peak at $117,000 in August 2025. The common whole period of this cycle, encompassing pre- and post-Halving rallies, has traditionally been round 2.6 years, with symmetry noticed throughout cycles.

Associated Studying

Pantera Capital highlights the connection between Halving occasions and BTC’s worth. The agency asserts that if the demand for brand new Bitcoin stays fixed whereas the provision of latest Bitcoin is diminished by half, it can create upward strain on the value.

The anticipation of a worth improve has additionally traditionally pushed elevated demand for Bitcoin main as much as Halving occasions. Nonetheless, Pantera Capital acknowledges that the affect of every subsequent Halving on worth could diminish because the discount within the provide of latest Bitcoin from earlier Halvings turns into much less important.

Furthermore, the agency notes that, on common, the Pantera Bitcoin Fund has almost doubled in worth for eleven years. Based mostly on this historic efficiency, Pantera Capital envisions a situation during which the value of Bitcoin reaches $117,000 by 2025.

Bullish Bitcoin Worth Predictions

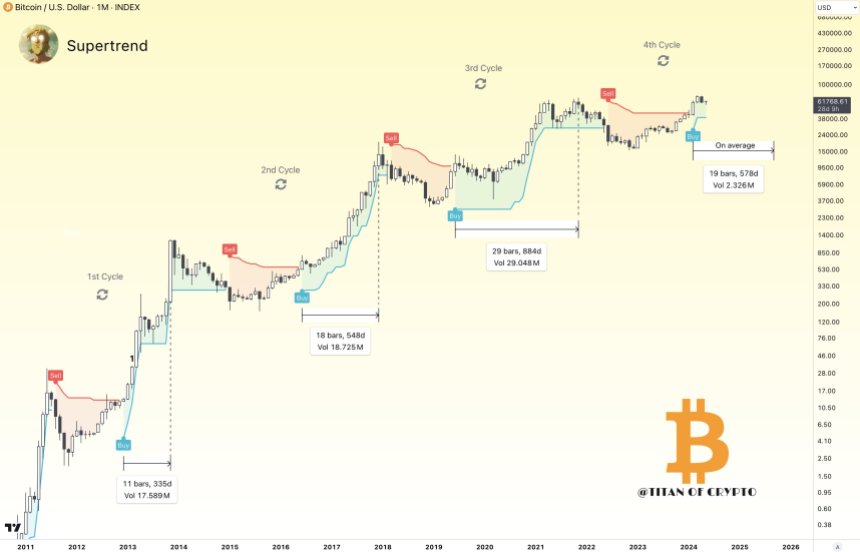

Famend crypto analyst Titan of Crypto has lately taken to social media platform X (previously Twitter) to share bullish predictions for the Bitcoin worth. With forecasts starting from $75,000 to $110,000, Titan of Crypto highlights varied elements and patterns that would doubtlessly drive BTC’s development.

In accordance to Titan of Crypto, a worth rise to $110,000 for Bitcoin is “programmed.” Whereas the analyst didn’t elaborate on the specifics of this programming, it suggests a powerful conviction in BTC’s potential to achieve that degree.

Titan of Crypto additionally identifies a present head-and-shoulders sample within the Bitcoin worth chart. If this sample holds, the analyst means that BTC may rise to the $75,000 mark. If confirmed, this sample may signify a bullish pattern reversal and additional assist the projection of Bitcoin reaching greater worth ranges.

Associated Studying

The analyst additionally highlighted $61,500 as a important level to observe because of the potential of “panic promoting.” The analyst suggests many market contributors may react to this degree, doubtlessly growing promoting strain.

Lastly, based mostly on his evaluation, the analyst suggests a conservative worth prediction of $108,000. Nonetheless, Titan of Crypto believes that BTC’s worth could exceed this projection, indicating a extra optimistic outlook.

Featured picture from Shutterstock, chart from TradingView.com