In accordance with the most recent on-chain revelation, the Bitcoin community has been experiencing a gentle decline in high-value transactions over the previous few weeks. This sluggish exercise has been mirrored by the worth of the premier cryptocurrency, which has struggled to interrupt out of consolidation all through the month of April.

Previously week, the Bitcoin worth struggled to carry above $67,000 regardless of touching the extent a number of occasions. The worth of BTC has since been in a tumble and is down by greater than 2% within the final seven days, in keeping with information from CoinGecko.

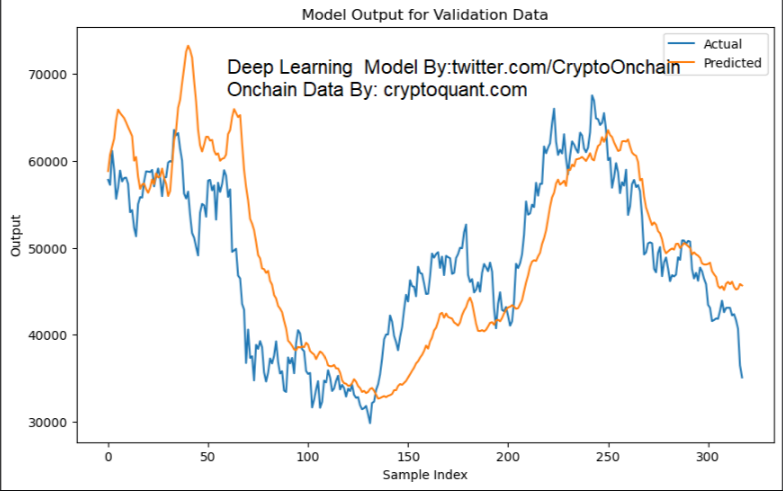

Apparently, the latest on-chain information means that this underwhelming worth efficiency would possibly persist for the market chief except there’s a turnaround, particularly by way of community exercise.

Can Whale Exercise Push BTC Worth Past $73,000?

Distinguished crypto analyst Ali Martinez took to the X platform to disclose that the Bitcoin whale exercise has been declining steadily prior to now six weeks. This revelation is predicated on Santiment’s Whale Transaction Rely metric, which tracks the variety of BTC transactions price greater than $100,000 and $1 million.

Whales discuss with entities or people that personal substantial quantities of a selected cryptocurrency (Bitcoin, on this case). As such, they maintain important affect over market dynamics attributable to their capability to execute massive transactions, which may set off hypothesis and potential worth shifts.

Martinez highlighted in his submit that there was a noticeable decline in Bitcoin whale exercise since March 14, the identical day the premier cryptocurrency hit a brand new all-time excessive worth of $73,737. This dip in exercise has coincided with the latest underperformance of Bitcoin’s worth.

Nevertheless, the crypto analyst talked about that a rise in high-value transactions might breathe life into the worth of BTC. That is based mostly on the reasoning {that a} surge in community exercise might suggest excessive demand for Bitcoin, resulting in elevated costs.

As proven within the chart under, the height of the whale transaction depend correlates with the brand new record-high worth of BTC.

Supply: Ali_charts/X

Energetic Bitcoin Wallets On The Rise: Santiment

An attention-grabbing piece of on-chain information which will counsel rising demand for Bitcoin and a bullish future for its worth has come to gentle. In accordance with Santiment, the variety of energetic Bitcoin wallets is rising quickly regardless of the uneven state of the market.

📊 The entire quantity of non-empty #Bitcoin wallets are quickly rising regardless of uneven costs. #Altcoin wallets for property like #Dogecoin have flattened after huge rises earlier this yr. #Cardano is without doubt one of the few networks to see energetic wallets drop. https://t.co/itg9qMes7c pic.twitter.com/yrOlEQw3jy

— Santiment (@santimentfeed) April 27, 2024

Energetic Bitcoin wallets discuss with the overall variety of distinctive addresses holding BTC. Santiment information reveals that the variety of these “non-empty BTC wallets” has climbed by greater than 2.5% within the final three months.

As of this writing, Bitcoin trades simply above $64,000, reflecting a 1.6% worth improve prior to now day.

BTC worth breaks above $64,000 on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site solely at your individual threat.