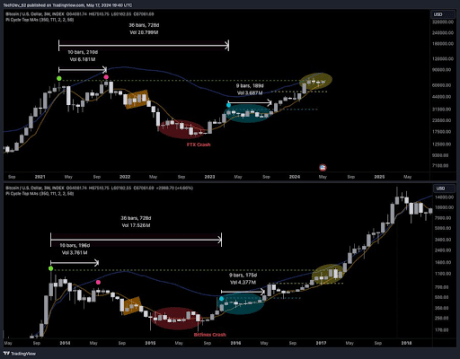

A crypto analyst has forecasted an “extremely bull situation” for Bitcoin, highlighting key assist ranges and technical patterns that recommend a value rally above $80,000 on this market cycle.

Bitcoin May See Upside Above $80,000

In a current X (previously Twitter) publish, a crypto analyst recognized as ‘CrediBullCrypto’ has doubled down on his earlier prediction of an ultra-bull situation for Bitcoin sooner or later. The analyst’s insights on Bitcoin’s current actions recommend that the draw back danger could also be much less important than beforehand anticipated, paving a bullish path for a large upside for Bitcoin.

Associated Studying

Sharing a graphical chart of Bitcoin’s value actions from April to Could 2024 in a YouTube video, Credibull Crypto predicted that Bitcoin may see its value rising above $100,000 on this projected ultra-bull situation. The focus of his evaluation was primarily based on the Open Curiosity (OI) in Bitcoin’s perpetual futures on Binance, the world’s largest crypto trade.

Based on the crypto analyst, Open Curiosity has reached 78,000 BTC, considerably larger than its baseline of 64,000 BTC. CrediBull Crypto revealed that this present Open Curiosity was in a hazard zone. It’s because the 14,000 BTC distinction sometimes signifies elevated market actions, which regularly precede unstable value actions.

Moreover, the CrediBull Crypto revealed {that a} single unidentified Bitcoin whale was accountable for roughly 10,000 BTC of the elevated 14,000 BTC Open Curiosity. Which means that the nameless whale controls 70% of all of the added Open Curiosity on Binance perpetual futures because the baseline.

He additionally disclosed that within the situation the place the nameless whale can stand up to 10% to fifteen% downward stress with out liquidating their belongings, the precise accessible Open Curiosity that might be susceptible to a decline can be solely 4,000 BTC, as a substitute of the preliminary 14,000 BTC addition. The analyst revealed that out of the 4,000 BTC, some can be directional shorts, noting that the online lengthy positions in danger can be even decrease.

Given this principle, CrediBull Crypto argued that the potential for a draw back is extra restricted. Because of this, the extremely bull situation the place Bitcoin’s value surges to new all-time highs was value contemplating.

Potential Retracement In the direction of $60,000

In his YouTube video, CrediBull Crypto additionally highlighted a possible retracement barely above the $60,000 value mark. The analyst predicted a bearish situation, the place Bitcoin may see its value falling considerably in direction of $62,000 to $63,000.

Associated Studying

On the time of writing, Bitcoin’s value is buying and selling at $69,774, reflecting a 0.08% lower within the final 24 hours, in accordance with CoinMarketCap. CrediBull Crypto disclosed that Bitcoin had failed to interrupt by way of key resistance ranges above $70,000.

He predicts that constant declines and liquidations may doubtlessly set off a backside beneath $60,000. Nevertheless, he additionally revealed that such a bearish turnaround was extremely unlikely right now, as Bitcoin’s value actions at the moment signifies an extremely bullish situation.

Featured picture created with Dall.E, chart from Tradingview.com