Bitcoin is now at a crucial junction, which many decide its worth trajectory for the remainder of the yr. The crypto has managed to return into $60,000 territory after dropping down to $56,000 for the primary time since April. Some analysts are of the notion that the Bitcoin bulls haven’t truly began on their momentum but, with many anticipating a surge above $74,000 within the coming weeks.

In line with a crypto analyst, impulse waves fashioned by Bitcoin over the previous 1.5 years are indicating that the value of Bitcoin will quickly bounce to between $90,000 and $100,000.

Bitcoin To $90,000

A crypto analyst identified pseudonymously as TechDev lately shared a Bitcoin worth outlook on social media platform X with over 448,000 followers. Curiously, his evaluation relies on Elliot impulse waves, a technical evaluation software that has develop into extraordinarily widespread amongst crypto analysts when forecasting Bitcoin’s worth.

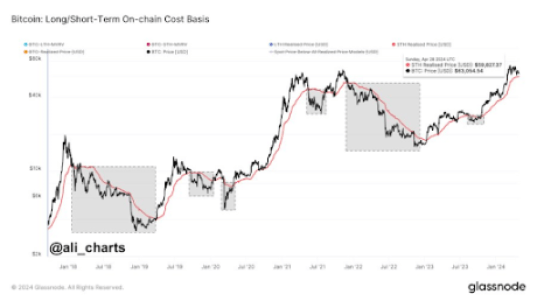

In line with the BTC/US Greenback 2D timeframe shared by the analyst, Bitcoin has been forming impulse waves on an uptrend since Could 2023. The chart indicated that the current correction since Bitcoin reached an all-time excessive of $73,780 is the fourth impulse wave formation, which is usually identified to be a corrective wave. Curiously, the asset is now at a crucial junction after bouncing up at $56,800.

As famous by the analyst, Bitcoin is about to type its fifth (bullish) impulse wave and go parabolic within the coming months. The primary worth goal is round $90,000 to $100,000 within the quick time period. The second worth goal is across the projected peak of the fifth impulse wave, which sits just under $150,000.

TechDev’s evaluation relies on the same five-impulse wave formation within the 2020 to 2021 bull market cycle. An identical fourth impulse wave correction throughout this era noticed Bitcoin falling from $41,000 to $29,000 in early 2021. Nevertheless, a rebound led to the formation of a fifth (bullish) impulse wave, pushing the value of Bitcoin to its former all-time excessive.

The impulsive construction of the final 1.5 years says 90-100K is subsequent. $BTC pic.twitter.com/jboA0rQ3Qs

— TechDev (@TechDev_52) May 3, 2024

What’s Subsequent For Bitcoin Value?

On the time of writing, Bitcoin is buying and selling at $63,275 and up by 6% up to now 24 hours. For the reason that launch of Spot Bitcoin ETFs within the US, Grayscale’s GBTC recorded its first day of influx, totaling $63 million on Could 3. Buyers are hopeful and speculating how this would possibly kickstart a brand new bull run for the cryptocurrency.

In line with an analyst, Bitcoin has efficiently defended a correction beneath the 21-day exponential shifting common (EMA). The subsequent step is crossing above resistance round $63,488.

BTC bulls push worth towards $64,000 | Supply: BTCUSD on Tradingview.com

Featured picture from The TechBullion, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site completely at your individual threat.