The Ethereum value has been closing mirroring the efficiency of Bitcoin just lately and for the reason that Bitcoin value has been on a downtrend, the ETH value has adopted. Nonetheless, Ethereum by itself appears to own extra bearish fundamentals in comparison with Bitcoin, main crypto analysts to consider that the second-largest cryptocurrency by market cap will fall farther from right here.

Ethereum Poised To Crash Additional

A crypto analyst referred to as Shin Foreign exchange took to the TradingView web site to share an attention-grabbing evaluation of the Ethereum value. The evaluation, which targeted on the ETH/BTC chart, unveiled some regarding developments within the ETH value.

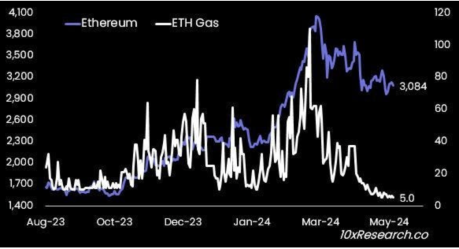

The analyst defined that in this time, the liquidity in Ethereum has been dwindling. As an alternative of flowing towards altcoins like ETH, it’s as a substitute flowing towards Bitcoin. This means rising disinterest in Ethereum from traders and as liquidity flows to Bitcoin, Ethereum has nothing propping it up right now.

Moreover, the crypto analyst explains that the ETH/BTC pair has now damaged under its help of 0.05. Now, this drop under its help stage is necessary given what has occurred every time that it broke. Shin Foreign exchange factors again to the final two market cycles, one in 2016 and one in 2019, of the ETH/BTC breaking under its help.

Each occasions that this has occurred, a crash within the value has adopted, earlier than it could actually rally once more. The crypto analyst doesn’t anticipate this time to be any totally different and believes that ETH/BTC will fall under 0.04. If this occurs, it’s going to ship Ethereum spiraling and the analyst has set a value goal of round $2,500 for this.

Can ETH Worth Survive The Crash?

Within the brief time period, the Ethereum value doesn’t look to good, particularly because the altcoin is presently trending downward inside its present channel, in keeping with the crypto analyst. Nonetheless, zooming out to the bigger timeframe can assist give an inkling of how the ETH value may carry out after the crash.

Shin Foreign exchange’s chart of the final two occasions {that a} formation like this occurred, it has additionally set a precedent for cash to movement again into Ethereum. In November 2016, the worth had crashed however in just a few months, there was an enormous restoration as ETH/BTC rose to a brand new all-time excessive.

Supply: TradingView.com

An analogous factor occurred the following time in 2019, with the crash coming forward of a market rally, albeit a bit slower right now. So, if this pattern holds, then the ETH crash is inevitable. Nonetheless, a restoration is anticipated that may doubtless kickstart the start of one other large rally.

For now, bears proceed to dominate the Ethereum market and have efficiently dragged the worth down under $3,000. It’s buying and selling at. $2,975 on the time of this writing, with a small 0.36% decline within the final day, in keeping with Coinmarketcap.

ETH value falls under $3,000 | Supply: ETHUSD on Tradingview.com

Featured picture from Quora, chart from Tradingview.com