In a landmark deal that may shake up the leisure panorama, Shari Redstone has agreed to promote management of Paramount World to a consortium led by Skydance, the manufacturing firm led by David Ellison, and Gerry Cardinale’s RedBird Capital.

The sale, assuming it’s authorized by regulators and accomplished (and assuming a greater bid doesn’t emerge), would see Skydance purchase Redstone’s majority stake in Nationwide Amusements, which in flip would safe management of Paramount, the proprietor of the Paramount movie and TV studios, Paramount+, CBS, and cable channels like Nickelodeon, MTV and Comedy Central.

The consummation of the deal is the end result of months of “will they or received’t they” hypothesis, with the Skydance consortium starting talks late final 12 months, solely to see a number of rounds of negotiations disintegrate when Redstone rejected the deal in place on the eleventh hour final month.

The 2 sides, nonetheless, continued speaking, resulting in a brand new deal that secured Redstone’s approval.

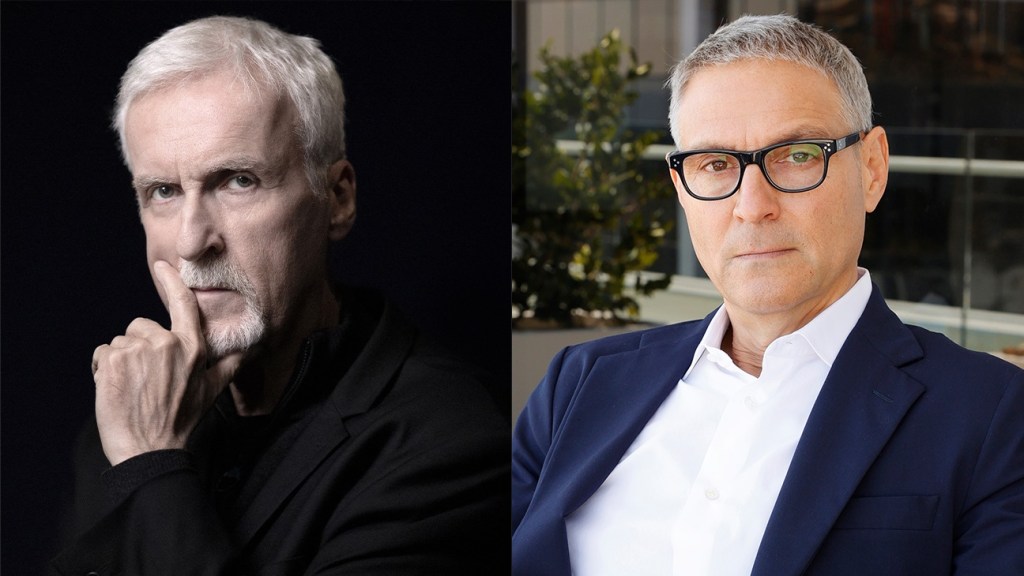

As soon as the deal closes, the plan is for Paramount to accumulate Skydance, which in flip will set up its personal management workforce on the tales leisure firm. Ellison will probably be CEO, with former NBCUniversal CEO Jeff Shell (at present working at RedBird) set to run the corporate day-to-day as its president.

Skydance needed to sweeten its deal supply in hopes of making certain extra worth for non-voting Paramount shareholders who had complained that preliminary deal provides had assured Redstone a premium however would have diluted them, giving them the brief finish of the stick.

In response to the businesses, the SKydance consortium will “make investments $2.4 billion to accumulate Nationwide Amusements for money and $4.5 billion for the inventory/money merger consideration to be paid for publicly traded Class A shares and Class B shares, in addition to $1.5 billion of major capital to be added to Paramount’s stability sheet”

The deal not solely buys out Redstone’s stake, but in addition permits pother Class A and Class B shareholders to money out as properly at $23 per share and $15 per share, respectively. Skydance says when it’s all mentioned and executed, it expects to personal 70% of shares excellent.

The all-stock deal to merge Skydance into Paramount will worth Ellison’s studio ay $4.75 billion.

Nationwide Amusements is a regional movie show chain; nonetheless, Sumner Redstone turned it right into a media behemoth by buying Viacom, Paramount and CBS. Nationwide Amusements owns solely about 10 p.c of Paramount’s fairness, however it controls about 80 p.c of its voting inventory, giving it management of the leisure agency.

Shari Redstone has run the corporate since her father’s demise in 2020.

“In 1987, my father, Sumner Redstone, acquired Viacom and started assembling and rising the companies at the moment referred to as Paramount World,” Redstone mentioned in an announcement Sunday evening. “He had a imaginative and prescient that ‘content material was king’ and was at all times dedicated to delivering nice content material for all audiences world wide. That imaginative and prescient has remained on the core of Paramount’s success and our accomplishments are a direct results of the extremely proficient, inventive, and devoted people who work on the firm.

“Given the modifications within the business, we need to fortify Paramount for the longer term whereas making certain that content material stays king,” she continued. “Our hope is that the Skydance transaction will allow Paramount’s continued success on this quickly altering atmosphere. As a longtime manufacturing associate to Paramount, Skydance is aware of Paramount properly and has a transparent strategic imaginative and prescient and the assets to take it to its subsequent stage of development. We imagine in Paramount and we at all times will.”

“This can be a defining and transformative time for our business and the storytellers, content material creators and monetary stakeholders who’re invested within the Paramount legacy and the longevity of the leisure financial system,” Ellison added. “I’m extremely grateful to Shari Redstone and her household who’ve agreed to entrust us with the chance to steer Paramount. We’re dedicated to energizing the enterprise and bolstering Paramount with modern expertise, new management and a inventive self-discipline that goals to counterpoint generations to come back.”

“The recapitalization of Paramount and mixture with Skydance beneath David Ellison’s management will probably be an necessary second within the leisure business at a time when incumbent media corporations are more and more challenged by technological disintermediation,” added Cardinale. “As one of many iconic media manufacturers and libraries in Hollywood, Paramount has the mental property basis to make sure longevity via this evolution — however it can require a brand new technology of visionary management along with skilled operational administration to navigate this subsequent part. RedBird is making a considerable monetary funding in partnership with the Ellison household as a result of we imagine that the professional forma firm beneath this management workforce would be the tempo automotive for the way these incumbent legacy media companies will have to be run sooner or later.”

By buying a majority of Nationwide Amusements, Skydance will have the ability to management Paramount, together with the celebrated studios (and all their related mental property), the published community, streaming service, and cable channels.

Paramount’s future has been the main target of intense hypothesis in current months, with its streaming enterprise nonetheless hemorrhaging money, its linear TV enterprise in continued decline, and with its credit standing on the ropes.

Along with Skydance, Apollo and Sony have kicked the tires of the corporate, which ousted its CEO Bob Bakish in April, changing him with a trio of executives within the “workplace of the CEO.”

Nationwide Amusements, too, has confronted challenges. The corporate took a $125 million strategic funding in Could from BDT & MSD Companions, with the proceeds paying down debt and paying again loans.

S&P World downgraded Paramount’s debt to BB+ in March, which is taken into account “junk” standing. “We downgraded Paramount because of the degradation of credit score metrics from the accelerating declines in linear media and the shift towards a extra aggressive and fewer sure streaming mannequin,” S&P’s Naveen Sarma wrote.

He added in a word after Bakish departed that the “shared administration construction just isn’t sustainable for Paramount World, or for any publicly traded firm, outdoors of a brief transitional interval.”

Nonetheless, the co-CEOs — Brian Robbins, George Cheeks and Chris McCarthy — had launched their very own plan for the corporate, and advised employees final month that they have been already executing on it.

“The Particular Committee want to thank our co-CEOs, George Cheeks, Chris McCarthy and Brian Robbins, for making vital progress on optimizing firm operations in a brief time period, positioning Paramount for a sustainable transformation and a path to worthwhile development going ahead,” mentioned Paramount board member and particular committee chair Charles Phillips.

With Skydance set to take management and set up new management and a brand new technique at Paramount, all of Hollywood and Wall Road will probably be watching.

Learn Shari Redstone’s memo to employees beneath.

Good night. Simply moments in the past, it was introduced that we now have entered into an settlement beneath which Skydance Media will purchase Nationwide Amusements and merge Skydance’s enterprise with Paramount World. I needed to take this chance to achieve out to you immediately not solely to share the information, however to precise my great gratitude to each one in every of you for what we now have been capable of accomplish collectively for the previous a number of many years.

As you already know, my father constructed Viacom and CBS by bringing collectively a bunch of one of the best belongings in media, information, and leisure. Whereas folks usually debated whether or not content material or distribution dominated the day, my father was ruled in all of his choices by his perception that content material was certainly king. That has by no means been extra necessary than it’s at the moment, when in a cluttered market, we proceed to create content material that resonates with our shoppers, that they regularly search out, and that retains them wanting extra. Our success is due to you, what you could have executed individually, and much more importantly, as a workforce.

Seeing the best way you could have come collectively since we launched Paramount World has been one of many highlights of my years at this firm, and your accomplishments are evident throughout the enterprise. Paramount+ is among the many fastest-growing streaming providers with an distinctive vary of content material interesting to all demographics. CBS has been the #1 broadcast community for 16 years and operating, with clear power throughout genres. Paramount Photos has produced eight #1 motion pictures prior to now two years alone and continues to create hit after hit. Our linear networks have delivered culture-shaping content material that excites audiences, together with the launch of the “Taylor Sheridan universe” with Yellowstone on the Paramount Community. And, Pluto TV is at the moment essentially the most extensively distributed FAST service.

As all this was achieved, we remained devoted to educating and informing ourselves and our audiences in our efforts to struggle hate and discrimination, and supporting different necessary causes within the US and world wide. I’m so grateful to all of you for what we now have been capable of accomplish to make a distinction.

Our household has at all times been dedicated to persevering with my Dad’s legacy and making certain Paramount’s enduring success. Per that, because the tempo of change within the business has continued to speed up, it has been our accountability to work with management to make modifications with a view to keep our aggressive place and gas development, pondering of each the close to and long term. Most lately, this led to the appointment of George Cheeks, Chris McCarthy, and Brian Robbins as Co-CEOs, to take the significant actions essential to bolster the Firm each operationally and financially. I feel we will all agree on their huge contributions to this firm. On the similar time, as you already know, our Board has centered on making certain we’re pursuing all alternatives to greatest place the Firm for the longer term and maximize worth creation for all shareholders.

As a longtime manufacturing associate to Paramount, Skydance is properly conscious of what we now have achieved over time and it’s for that motive that they’ve pursued a mixture with Paramount. They’ve a transparent strategic imaginative and prescient for the longer term and the assets to construct on Paramount World’s aggressive benefits to drive the Firm’s success.

The settlement we entered into at the moment is topic to closing situations, and we anticipate the deal to be accomplished within the first half of 2025. Till then, George, Chris, and Brian will proceed to steer the Firm, and they are going to be sharing extra with you shortly. I after all will even be right here to cheer you on, and help in any method that I can. It has really been my honor to work with all of you these previous a number of years, and to see so lots of our goals come to fruition.

I need to specific my deepest because of you in your dedication, arduous work, and most significantly your help of my household and me. In opposition to a difficult business backdrop and lots of modifications on the firm, you could have protected Paramount’s belongings and delivered for our audiences. As I’ve mentioned earlier than, and I’ll at all times say, we now have one of the best folks within the enterprise right here at Paramount and it’s really a privilege to work with you. I’ll at all times treasure the relationships I’ve had with you and the methods we now have labored collectively to tell apart ourselves in our business.

All one of the best, Shari

Learn the memo from Cheeks, McCarthy and Robbins beneath.

Hello Everybody,

At the moment marks an necessary milestone for Paramount, as we simply introduced a definitive settlement with Skydance Media. By combining Skydance with Paramount, we’d construct on our storied legacy to create a fair stronger, next-generation media and expertise chief, positioned to win in at the moment’s quickly remodeling media panorama.

As Shari shared, we anticipate this transaction to shut within the first half of 2025, because it’s topic to regulatory approvals and different steps needed to finish the deal. The settlement additionally consists of what’s referred to as a “go-shop” provision, which implies that the Particular Committee of Paramount’s Board of Administrators and its representatives will probably be permitted to actively solicit and consider different acquisition proposals for a 45-day interval.

Till the transaction closes, it’s enterprise as normal – we are going to proceed to function as an unbiased firm and transfer ahead with the strategic plan we outlined at our city corridor. This consists of actions to modernize our group by streamlining groups, eliminating duplicative capabilities and decreasing the scale of our workforce. We will even proceed to discover alternatives to remodel world streaming and optimize our asset combine by divesting a few of our belongings.

We now have been on a journey to remodel Paramount for the longer term, and due to your arduous work, Paramount brings great worth to this mixture with Skydance. Paramount continues to be the house of invaluable IP that powers one of the best that leisure has to supply to audiences world wide, and a vibrant inventive tradition. And, our belongings are among the many most compelling within the business, together with the primary US broadcast community with CBS and our main free-to-air networks within the UK, Australia, Argentina, and Chile; iconic manufacturers like Nickelodeon, MTV, BET, and Showtime; a high 5 SVOD service within the US with Paramount+; and a number one world free ad-supported streaming service in Pluto TV. And naturally, Paramount Photos continues to create genre-spanning movies that ship on the field workplace, most lately with A Quiet Place: Day One – the newest addition to our 100-year-old movie library.

This transaction would mix Skydance’s monetary assets, deep working expertise, and cutting-edge expertise with Paramount’s iconic IP, deep movie and tv library, confirmed hit-making capabilities, and linear and streaming platforms that attain hundreds of thousands of viewers. And, we already know Paramount and Skydance, led by David Ellison, can obtain unbelievable outcomes collectively, as evidenced by our robust, 15-year collaboration that has delivered extremely profitable movies and franchises like High Gun: Maverick and Mission: Unattainable – Fallout.

The Paramount that we all know at the moment wouldn’t be doable with out the management of Shari and the Redstone household. It’s due to their imaginative and prescient and help over the numerous years that we’re one of many main world leisure corporations on the earth, with one of the best workforce within the enterprise. We want to sincerely thank Shari and her complete household for his or her unwavering help and management. We’d additionally wish to thank our Board of Administrators, who’ve helped information us alongside the best way. We recognize all that they do on behalf of Paramount.

And most significantly, we need to thank all of you, our Paramount World workforce, for all you could have executed and proceed to do to drive Paramount to new heights.

We all know you’ll have questions and we’ll share as a lot info as we will all through this course of. Within the meantime, you’ll be able to learn extra concerning the settlement within the press launch right here.

Thanks,

George, Chris and Brian