Bitcoin

Are New Altcoins Listing On Exchanges Like Binance Profitable? This Crypto Researcher Has The Answer

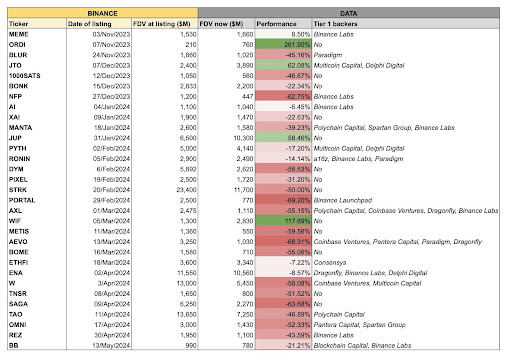

A crypto and macro researcher recognized as “Circulate” on X (previously Twitter) has offered an in depth evaluation of the profitability of new altcoins listed on Centralized Exchanges (CEX) corresponding to Binance. The researcher disclosed that distinguished exchanges like Binance have skilled a major decline within the worth and efficiency of recent tokens listed on their platform.

80% New Listed Altcoins On Binance Are Down

Studies from Circulate recommend that new tokens listed on CEXs’ are usually not as worthwhile as they as soon as have been. Highlighting all of the listed tokens on Binance from the previous six months, the crypto researcher famous that 80% of those new altcoins have declined massively, with their worth falling beneath their preliminary itemizing worth.

Most of those tokens have been listed on Binance from November 2023 to Might 2024. New tokens like BLUR, which was built-in on November 24, 2023, plummeted significantly, recording a forty five.6% lower in efficiency.

However, excluding two altcoins, all tokens listed from the start of 2024 have declined. Probably the most important drop was recorded by a token known as PORTAL, which decreased 69.2% from its itemizing date on February 20, 2024.

Solely 4 cryptocurrencies recorded important positive factors from the 32 newly listed tokens on Binance. Meme cash like Ordinals (ORDI) and Dogwifhat (WIF) skilled the biggest positive factors, 261.9%,i and 117.69%, respectively. On the similar time, others like Jito (JTO) and Jupiter (JUP) noticed positive factors above 50%.

Circulate has disclosed that if buyers had diversified their portfolios by investing equal quantities in every of Binance’s newly listed tokens, they’d have suffered a major 18% decline over the previous six months.

The macro researcher famous that when tokens launch at an elevated Totally Diluted Valuation (FDV), they have an inclination to depreciate, finally underperforming. He disclosed that a lot of the tokens listed on Binance are backed by Tier1 VC and launched at extraordinarily excessive costs, leading to substantial revenue taking and a major decline.

New Tokens Have No Actual Customers

In line with Circulate, new altcoins launching on Binance are now not worthwhile funding automobiles, as their excessive FDV at launch removes most of their upside potential. He indicated that these newly listed altcoins at present function exit liquidity for insiders, who exploit retail buyers‘ restricted entry to high quality funding alternatives.

Moreover, the crypto researcher disclosed that newly listed crypto tasks on Binance don’t have any actual customers or a powerful neighborhood backing them. Their tendency to launch at excessive FDV additionally results in unsustainable development, which discredits the broader crypto trade.

Circulate asserted that investing in newly listed tokens was a rigged sport, highlighting a remark made by economist Alex Kruger, who said:

Most tokens launching as of late are engineered to pump and inevitably dump. This occurs as a result of founders set very quick vesting schedules, pretend metrics, and concentrate on hype quite than on person acquisition.

Kruger additionally revealed that automated buying and selling bots and market makers drawback strange buyers by shopping for giant quantities of tokens at launch costs and promoting them at considerably larger costs.

Chart from Tradingview.com