Bitcoin

Big Buyers Fueling Rally On Top Crypto Exchanges

Pushed by a mixture of optimistic components, Solana (SOL) is seeing a spike in buying and selling exercise. This covers huge purchase orders, institutional buyers’ savvy buying method, and the anticipated launch of SOL-based exchange-traded funds (ETFs).

Associated Studying

Whales Consolidate SOL discretely

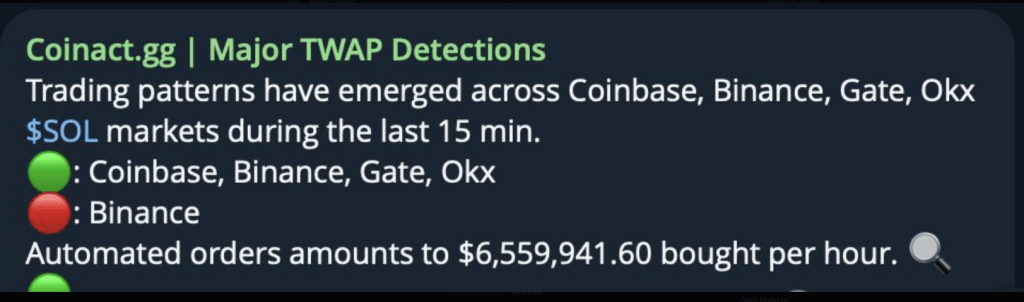

Buying and selling knowledge exhibits a notable improve in buying and selling quantity amongst key exchanges together with Binance, Coinbase, Gate.io, and OKX. Nonetheless, a extra in-depth evaluation by Coinact.gg, which is a real-time buying and selling analysis programme, signifies a sample that could be very intriguing: a “Main TWAP” sign for SOL.

Main TWAP Detection alert on $SOL. Bigger consumers are accumulating $SOL #Solana.

Buying and selling patterns have emerged throughout @coinbase , @binance , @gate_io , @okx $SOL markets over the last 15 min.

🟢️: Coinbase, Binance, Gate, Okx

🔴️: Binance

Automated orders quantities to… pic.twitter.com/TXpnfprQPn— MartyParty (@martypartymusic) July 10, 2024

Huge buyers, notably monetary establishments, sometimes make use of a method often known as Time-Weighted Common Value, or TWAP for brief. It is not uncommon apply to unfold out a big purchase order over a sure time interval with a purpose to reduce the influence it has in the marketplace value.

The implication of that is that institutional gamers are purposefully accumulating SOL with out inflicting huge value actions, which is a traditional indicative of a long-term optimistic outlook.

ETF Hype Ignites Investor Curiosity

As well as, the announcement that possible SOL-oriented exchange-traded funds (ETFs) would possibly hit the market by the center of March 2025 is producing curiosity amongst buyers. On account of the Chicago Board Choices Trade (CBOE)’s latest submission of proposals to listing exchange-traded funds (ETFs) supplied by VanEck and 21Shares, the bitcoin group has been full of pleasure and hypothesis.

Solana Value Forecast

Quite a few analysts are projecting a steady rise in SOL value; others estimate a 17% achieve by August tenth below underlying cautious optimism. Moreover displaying a optimistic development are technical indicators.

Associated Studying

Measuring normal market temper, the Concern & Greed Index comes out as “Concern” (29). This suggests that though buyers are largely hopeful about SOL’s potentialities, sure elementary points stay current within the bigger crypto business.

The disparity seen in Binance’s commerce statistics relative to different exchanges raises some questions. Extra analysis is required to search out the reason for this various behaviour because it might factors to a definite market dynamic appearing particularly on Binance.

ETFs’ promise of simply accessible, regulated SOL investing decisions is drawing a contemporary era of buyers, particularly these beforehand reluctant to barter the complexity of cryptocurrency exchanges. The maintain 8% value rise for SOL within the weekly timeframe displays this greater demand enabling community to pedal its manner again to the $142 subject.

Fueled by a convergence of beneficial circumstances, Solana’s future appears shiny. Optimistic outlook is offered by institutional investor curiosity, the potential for regulated ETFs and up to date value rise.

Featured picture from Pexels, chart from TradingView