Bitcoin

Bitcoin And Mining Industry Poised For Success — Study

As Bitcoin carves out a place on the planet’s monetary panorama, latest occasions within the US have given it a brilliant future. At the very least, that is what an analyst at H.C. Wainwright & Co. sees.

Mike Colonnesse provided a weekly research on July 30 outlining a number of constructive parts driving the Bitcoin and BTC mining sector together with institutional momentum, anticipated legislative reforms, and political endorsement.

Trump’s Agenda On The Market

The skilled detailed former President Donald Trump’s essential place in crypto. Trump, presently operating as a Republican, mentioned his cryptocurrency concept at Bitcoin 2024. One in every of his objectives is to make america the dominant international drive in Bitcoin mining and arrange a authorities financial institution with about $12 billion in Bitcoin.

Trump’s suggestions are barely distinctive. Whereas Senator Lummis has developed a strategic reserve plan, unbiased candidate Robert F. Kennedy has proposed hoarding a million Bitcoin. Collectively, these political sponsorships would possibly assist elevate consciousness on cryptocurrencies among the many plenty, Colonnesse stated.

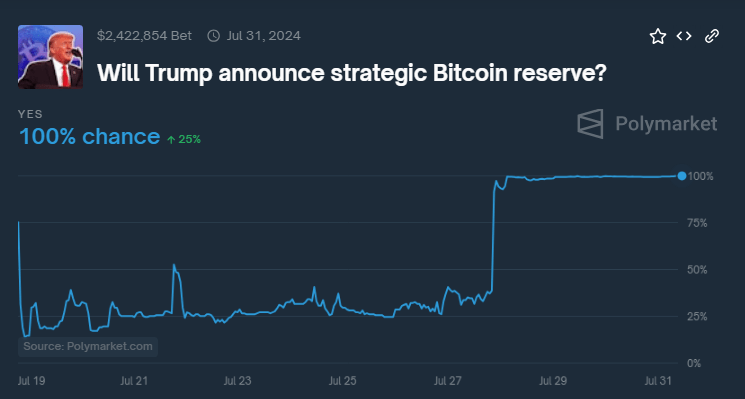

Polymarket figures present Trump’s odds of saying a strategic Bitcoin reserve to be at an explosive 100%. Ought to he discover himself sitting once more within the Oval Workplace, this could help further institutional funding and assist to solidify Bitcoin’s standing as a nationwide asset.

Regulatory Reorganization: Potential SEC Adjustments

In the meantime, the anticipated political change would possibly have an effect on the regulatory environment. Constructive information for the digital asset market might come from Trump’s election — and the possible alternative of Gary Gensler, the chairman of the Securities and Trade Fee (SEC).

Gensler’s time period has been outlined by extreme legislative strikes towards crypto belongings and blockchain funding. His exit might set the stage for much less strict guidelines, which might encourage innovation and development for the final crypto house.

Based mostly on his findings, Colonnesse stated that due to heightened institutional acquisition by means of spot exchange-traded funds (ETFs) and the potential for regulatory readability underneath the brand new SEC management, the general Bitcoin sector would possibly attain new heights within the subsequent 12 months.

Supply: H.C. Wainwright & Co.

Environmental Points, Sentiment, Shortage Outline Market Dynamics

These elements ought to enhance Bitcoin costs attributable to shortage. Bitcoin costs usually climb after halving occasions, which lower new Bitcoin technology. Provide-demand forcing Bitcoin into reserves and institutional holdings might elevate costs.

Nonetheless, sure difficulties are forward. Among the many doable challenges Colonnesse notes are main authorized and regulatory penalties, environmental issues with Bitcoin’s energy-intensive proof-of-work mining methodology, and pure market volatility.

Governments around the globe are actively watching the habits cryptocurrencies. Any main disruption or ban would possibly threaten market viability and investor belief. Nevertheless, Bitcoin’s economic system is rising regardless of these limits.

Featured picture from Vecteezy, chart from TradingView