Bitcoin

Bitcoin Exits Exchanges For Coinbase, Will It Affect Price?

On-chain information exhibits Bitcoin has been shifting to Coinbase from different exchanges. Right here’s what this has traditionally meant for the asset.

Bitcoin Coinbase Movement Pulse Has Turned Again Inexperienced Just lately

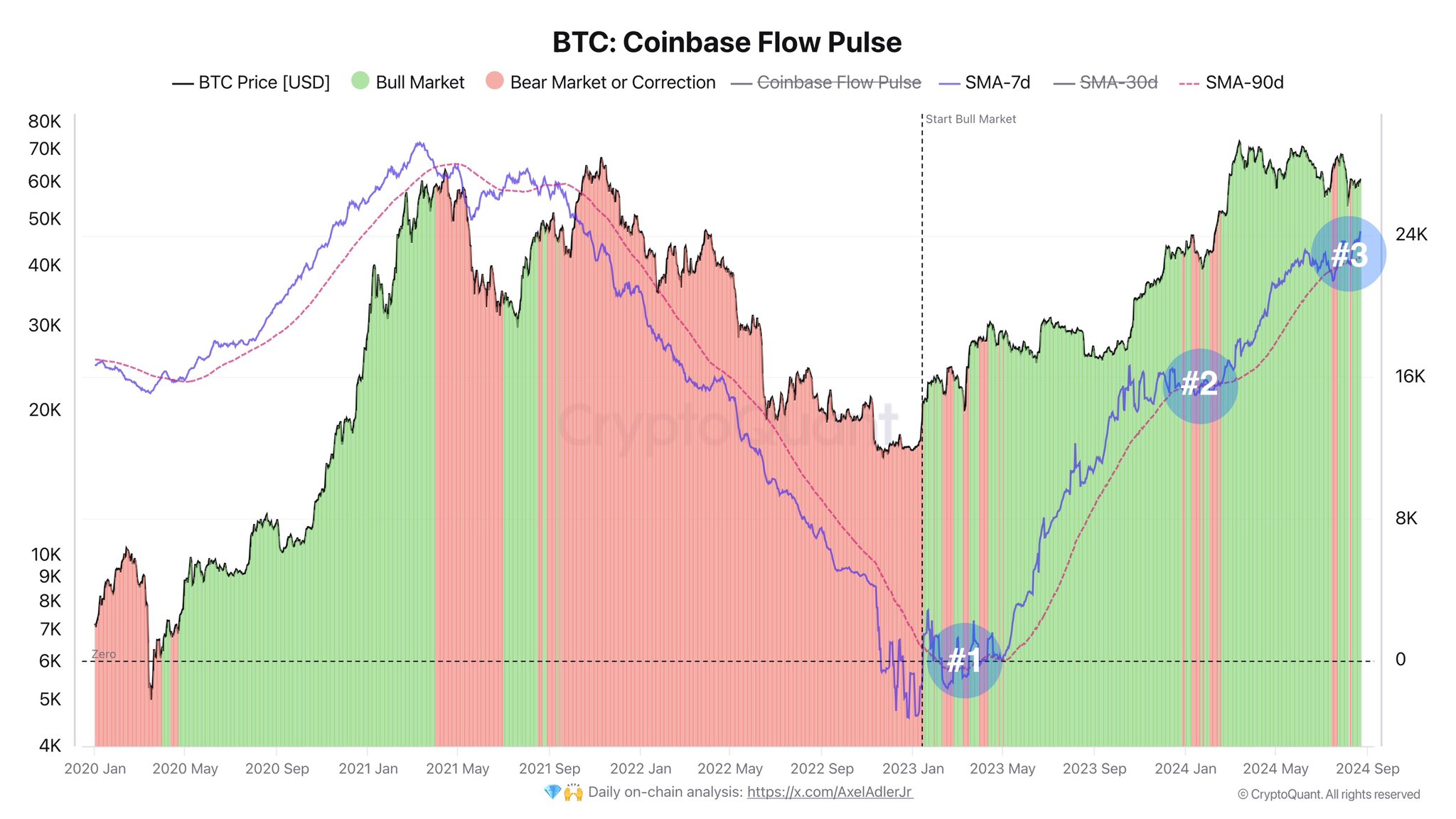

As defined by CryptoQuant writer Axel Adler Jr in a brand new publish on X, Coinbase has resumed inflows from different exchanges not too long ago. The indicator of relevance right here is the “Coinbase Movement Pulse,” which retains observe of the online quantity of Bitcoin flowing between Coinbase and the opposite cryptocurrency exchanges.

Beneath is the chart shared by the analyst that exhibits the development within the 7-day shifting common (MA) of this indicator over the previous couple of years.

Seems to be like the worth of the metric has been heading up in current days | Supply: @AxelAdlerJr on X

As is seen within the graph, the Bitcoin Coinbase Movement Pulse has been constructive since mid-2023, that means that Coinbase has been receiving web inflows from the opposite centralized exchanges.

Nevertheless, the indicator’s development about its 90-day MA is extra related, nonetheless, proven in the identical chart. The analyst has outlined two zones for BTC primarily based on the place the 7-day MA is in comparison with this long-term MA.

When the 7-day MA crosses below the 90-day MA, BTC will seemingly show bearish motion, so intervals like this are categorized as “Bear Market or Correction” (highlighted in pink). Equally, the metric above this line implies “Bull Market” (inexperienced).

From the graph, it’s obvious that the 7-day MA of the Coinbase Movement Pulse had fallen below the 90-day MA simply earlier, however now, the 2 have crossed again, implying that demand for shifting cash to Coinbase has picked again up.

The final time this sample fashioned for the cryptocurrency was simply earlier than the rally in direction of the brand new all-time excessive (ATH). Thus, this sign may be bullish for the worth this time.

As for why Coinbase could also be related on this method for the asset, the reply might lie in the truth that the platform is the recognized vacation spot of American institutional entities. As such, a stream of cash from different exchanges into Coinbase might indicate demand from these US-based whales.

Whereas the market outlook seems constructive from the attitude of the Coinbase Movement Pulse, one other indicator from the on-chain analytics agency CryptoQuant is probably not so brilliant.

As CryptoQuant Head of Analysis Julio Moreno has defined in an X publish, Bitcoin demand continues to be muted when contemplating the “Obvious Demand” metric, which strives to estimate the demand current in the whole market and never only a part of it just like the Coinbase Movement Pulse.

The worth of the metric seems to have been impartial not too long ago | Supply: @jjcmoreno on X

Whereas the demand for Bitcoin was at vital ranges earlier within the 12 months, it appears to have fallen off exhausting after the lengthy consolidation streak, because the Obvious Demand is presently at roughly impartial values.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $61,000, up over 5% previously week.

The value of the coin appears to be slowly making its means up | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com