Bitcoin

Bitcoin Hashrate Plunges 11% As Miner Profits At 3-Year Lows

On-chain knowledge reveals the Bitcoin mining hashrate has registered a lower of 11% just lately as miner profitability has dropped to a 3-year low.

Bitcoin Miners Haven’t Been Beneath This A lot Stress In 3 Years

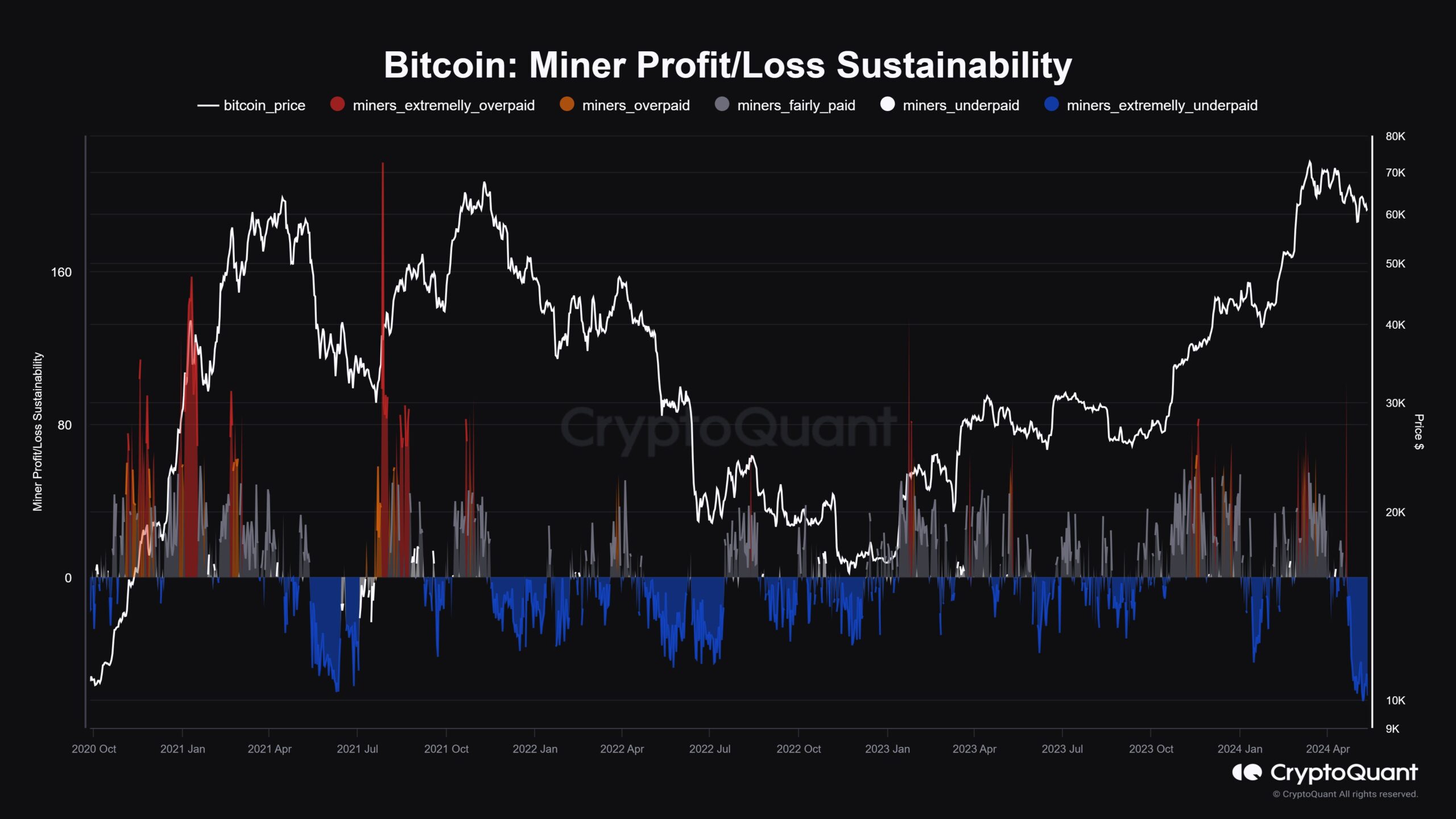

As identified by CryptoQuant group supervisor Maartunn in a post on X, Bitcoin miners are being considerably underpaid proper now. The indicator of relevance right here is the “miner revenue/loss sustainability,” which principally tells us whether or not the miner revenues are honest or not presently.

Right here is the chart shared by the analyst that reveals the pattern on this BTC metric over the previous couple of years:

The worth of the metric appears to have been fairly unfavourable in latest weeks | Supply: @JA_Maartun on X

From the chart, it’s seen that the Bitcoin miner revenue/loss sustainability had been at optimistic ranges earlier when the rally in direction of the brand new all-time excessive had occurred.

Miners make their revenue from two sources: the block rewards that they obtain for fixing blocks on the community and the transaction charges that they get as compensation for dealing with particular person transfers.

Throughout rallies, switch charges can spike as a consequence of excessive community exercise and block rewards turn into extra beneficial because of the rising BTC worth. As such, it’s not shocking that the profitability of those chain validators was at notable ranges throughout the earlier surge.

Just lately, nonetheless, the indicator’s worth has plunged deep into the unfavourable territory, implying miners have turn into extraordinarily underpaid. Bitcoin has gone by way of some bearish worth motion on this interval, however the decrease spot worth isn’t the one motive that miner financials have now come beneath stress.

The much-anticipated Halving that occurred final month could be the a lot larger issue at play right here. Throughout this occasion, BTC’s block rewards have been completely slashed in half, so it’s simple to see how it might have an effect on mining economics.

Apparently sufficient, the Halving day itself noticed fairly excessive revenues for miners, with the miner revenue/loss sustainability capturing into the overpaid territory, as is seen by the lone spike within the chart. This was a results of the arrival of Runes on the community.

This new protocol, which permits customers to mint fungible tokens on the Bitcoin community, noticed rapid recognition, and the ensuing transaction exercise despatched blockchain charges hovering. Nevertheless, the hype couldn’t final for too lengthy, although, and transaction charges have as soon as once more returned again to decrease ranges.

The halved rewards mixed with the comparatively low charges are why miner profitability has taken such successful. “That is more likely to trigger substantial pressure, particularly for much less environment friendly miners,” notes Maartunn.

It will seem that a number of the miners beneath stress have already began pulling out, because the Bitcoin hashrate, a measure of the computing energy related to the community by the miners, has seen a decline of 11% in its 7-day common chart for the reason that all-time excessive set alongside the Halving.

Seems to be like the worth of the metric has been declining just lately | Supply: Blockchain.com

Miners can now solely hope for the BTC worth to see sufficient surge in order to offset the income lower attributable to the Halving, or for the transaction charges to maybe see one other increase.

BTC Value

Bitcoin has seen one more restoration rally fizzle out because the asset’s worth has dropped to $61,700 after having returned again above $63,000 yesterday.

The worth of the coin has continued to consolidate over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Erling Løken Andersen on Unsplash.com, Blockchain.com, chart from TradingView.com