Bitcoin

Ethereum Suffers 3rd Straight Weekly Outflows

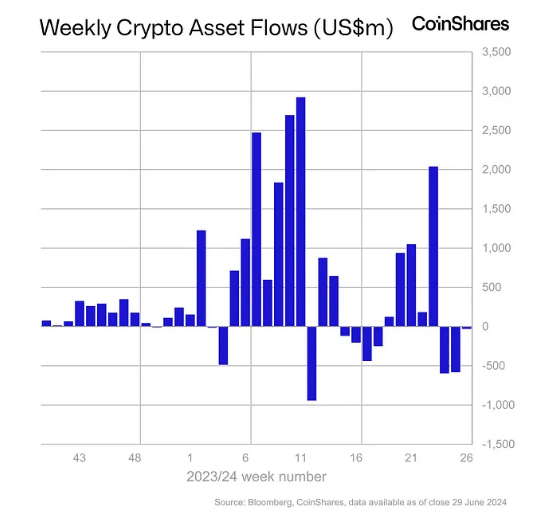

The digital asset market is experiencing a wave of investor warning, with Ethereum main the cost. CoinShares reviews present a 3rd consecutive week of outflows, with Ether sustaining the most important harm. This adverse sentiment within the prime altcoin, coupled with sluggish buying and selling volumes and regional outflows throughout the market, paints an image of a market looking for route.

Associated Studying

Ethereum Faces Headwinds Regardless of Upcoming Milestone

Ethereum, the world’s second-largest cryptocurrency, has seen the worst outflows of any digital asset this 12 months, reaching a staggering $61 million final week. The dismal determine could possibly be attributed to the delay in approving a spot Ethereum ETF, a extremely anticipated occasion that has been within the works for practically three years.

In accordance with CoinShares, digital asset funding merchandise noticed $30 million in outflows final week, the third consecutive week of outflows. Ethereum noticed its largest outflow since August 2022, totaling $61 million, making it the worst performing digital asset funding product so…

— Wu Blockchain (@WuBlockchain) July 1, 2024

The lengthy look ahead to regulatory greenlight is perhaps inflicting traders to carry off on commitments, creating uncertainty within the Ethereum market. Nonetheless, the upcoming launch on July 4th stays a pivotal second. Analysts are intently watching to see if this long-awaited growth triggers a surge in Ethereum adoption or if it merely cannibalizes present Bitcoin ETF investments.

Combined Indicators: Regional Divergence And Altcoin Curiosity

Whereas the general development factors in direction of warning, there are regional variations in investor sentiment. The USA, for instance, defied the worldwide development and witnessed inflows of $43 million, suggesting continued American curiosity within the digital asset area.

Equally, inflows into multi-asset and Bitcoin Change-Traded Merchandise (ETPs) point out a choice for diversification and established gamers. This highlights the continued attraction of a broader publicity to the digital asset panorama, slightly than a singular concentrate on anybody cryptocurrency.

Curiously, amidst the Ethereum outflow woes, some altcoins are experiencing a resurgence. Solana and Litecoin, as an illustration, noticed inflows, suggesting that traders are searching for alternatives past the highest two cryptocurrencies. This diversification could possibly be an indication of a maturing market the place traders are conducting a extra thorough threat evaluation and exploring undervalued gems inside the huge digital asset ecosystem.

Associated Studying

Navigating Unsure Waters

The present state of the digital asset market is considered one of cautious optimism. Whereas outflows and Ethereum’s struggles are simple considerations, constructive inflows in particular areas and merchandise supply a counterpoint.

The upcoming Ethereum ETF launch is a wild card, doubtlessly performing as a catalyst for additional adoption or just reshuffling present investments. Traders are more likely to stay watchful within the close to future, fastidiously weighing threat and reward earlier than making important commitments.

Featured picture from Dad and mom, chart from TradingView