Bitcoin

Here’s Why XRP and Cardano Might Not See ETFs Anytime Soon — Report

The realm of cryptocurrency ETFs seems to be now increasing, but not all digital property are poised for a simple transition into this monetary product. GSR’s current evaluation of the potential for ETFs throughout varied crypto has introduced ahead insights that place XRP and Cardano in a difficult place for ETF adaptation.

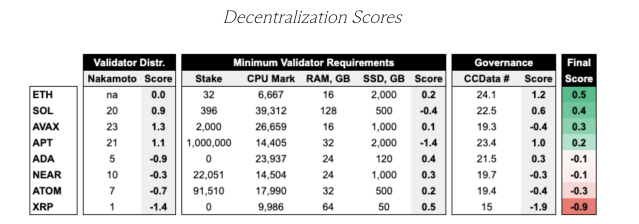

Utilizing a complete scoring system, GSR evaluates the cryptocurrencies on a scale integrating decentralization metrics and market demand indicators.

XRP And Caradano: By no means To See The Mild of ETF?

Decentralization is vital, analyzing facets equivalent to permissionless participation and the variety of {hardware} used within the networks.

Key metrics just like the Nakamoto Coefficient measure the focus of operational energy throughout the community, revealing vulnerabilities to potential collusion or management by a number of entities.

For XRP and Cardano, the decentralization scores have been notably low, with XRP at -0.9 and Cardano at -0.1, indicating considerations over their community buildings.

Along with decentralization, demand potential is equally important, contemplating market cap, buying and selling quantity, and neighborhood exercise ranges. These elements predict how a lot curiosity there is likely to be in an ETF based mostly on every cryptocurrency.

Regardless of their reputation, XRP and Cardano scored -0.2 and -0.5 in demand metrics, putting them behind different cryptocurrencies exhibiting stronger future market demand indicators.

This mixture of decrease decentralization and demand scores in GSR’s evaluation means that XRP and Cardano would possibly face substantial hurdles earlier than seeing the launch of their ETFs, particularly in a market that’s rapidly adapting and evolving.

In the meantime, in distinction to the sluggish outlook for XRP and Cardano ETFs from the GSR report, different cryptocurrencies like Ethereum, Solana, and NEAR are seeing extra optimistic evaluations.

Highlight on Solana And The Different Authorised ETFs

Notably, merging the evaluations from the property, GSR’s methodology for the ETF Risk Rating assigns a weight of 33% to decentralization and 67% to demand in its general scoring system.

Regardless, VanEck, a big participant within the asset administration discipline, has taken a pioneering step by submitting for the first-ever Spot Solana ETF with the US Securities and Alternate Fee (SEC).

This transfer underscores Solana’s rising stature as a notable competitor to Ethereum. In line with Matthew Sigel, VanEck’s head of digital asset analysis, “With its mixture of scalability, pace, and low prices, the Solana blockchain has the potential to offer an enhanced consumer expertise throughout a variety of use circumstances.”

Nevertheless, the panorama for Bitcoin and Ethereum stays blended. Whereas Bitcoin spot ETFs have skilled fluctuating inflows, Ethereum’s potential ETF remains to be pending closing S-1 approvals, anticipated to materialize quickly.

The market’s reception to those developments has been cautious, reflecting the gradual tempo of inflows for spot Bitcoin ETFs regardless of a optimistic development over current days.

Featured picture from DALL-E, Chart from TradingView