Bitcoin

New Cryptocurrency Releases, Listings, & Presales Today – Drift, BounceBit, Venom

Be a part of Our Telegram channel to remain updated on breaking information protection

The crypto market opened the week with a minor value uptick as new cryptocurrency releases, listings, & presales immediately witnessed elevated investor consideration. The worldwide crypto market cap elevated by 0.67% over the previous 24 hours, reaching $2.45T. The entire crypto market quantity grew by 44.48% in the identical time-frame to $71.57B.

InsideBitcoins gives an outline of latest digital belongings belongings match for consideration within the present market outlook. This text curates particulars on their options, utilities, and market outlook.

New Cryptocurrency Releases, Listings, and Presales Right now

Drift is a decentralized alternate (DEX) working on the Solana blockchain, which facilitates buying and selling in each perpetual and spot markets. In the meantime, BounceBit is within the means of creating a BTC restaking infrastructure to ascertain a foundational layer for quite a lot of restaking merchandise. On one other entrance, the Venom blockchain is designed to handle key points which have impeded the widespread adoption of decentralized purposes, similar to gradual transaction confirmations, excessive charges, and restricted scalability.

Following WienerAI’s launch in mid-April, the undertaking raised over $7.5 million, highlighting investor optimism relating to the WAI token’s potential progress. Apart from, Bitcoin and Ethereum have remained steady, whereas Dogecoin skilled a spike after Biden determined to bow out of the presidential race.

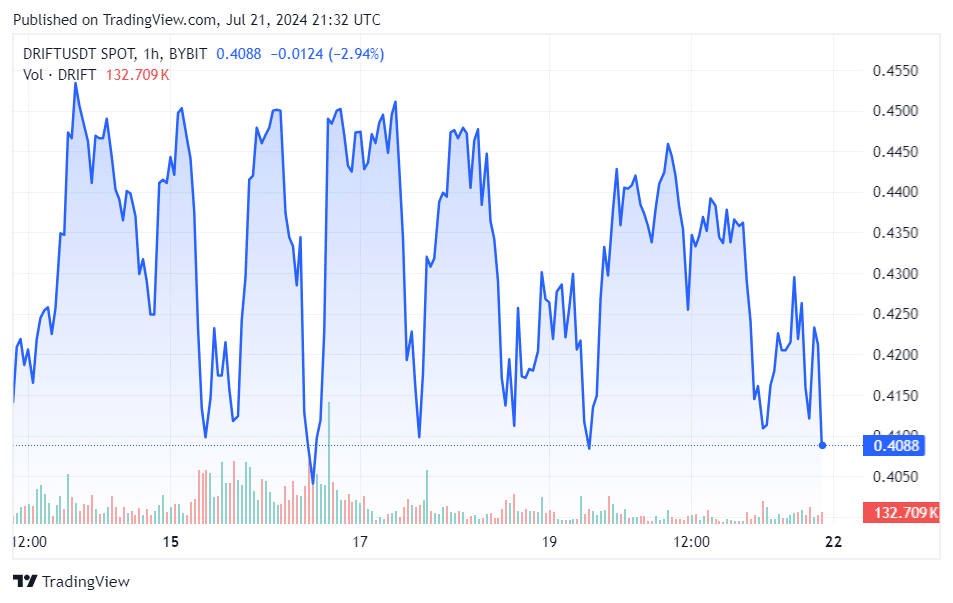

1. Drift (DRIFT)

Drift is a decentralized alternate (DEX) working on the Solana blockchain. It facilitates buying and selling in perpetual and spot markets, providing leverage as much as 10x. The platform helps buying and selling in each pre-launch markets and established tokens, thereby enhancing capital effectivity by permitting quite a lot of belongings for use as collateral.

Drift gives a number of instruments to handle positions effectively. For example, customers can commerce markets with as much as 10x leverage for perpetual futures and swaps. Equally, spot buying and selling permits buying and selling belongings with as much as 5x leverage, and token swaps allow swapping any pair with as much as 5x leverage.

Moreover, Drift goals to steadiness capital effectivity and asset safety by a classy cross-margined threat engine. This consists of utilizing collateral for perpetual futures and spot buying and selling, incomes by lending deposited tokens, which additionally function collateral for swaps, and proscribing borrowing to make sure debtors have satisfactory collateral, with a number of security measures in place.

Moreover, customers can generate yield by a number of choices. For instance, lending and borrowing enable customers to earn yield on deposits. Then again, insurance coverage fund staking lets customers stake belongings in a vault to earn from alternate charges. Furthermore, market maker rewards provide an opt-in market-making Alpha Program, whereas backstop AMM liquidity (BAL) gives leveraged liquidity to earn yield.

Pre-market valuation places $CLOUD at $0.3287 ☁️

What is going to the worth be an hour after launch? 👀

Greatest prediction will get 99 DRIFT 👇

— Drift Protocol (@DriftProtocol) July 16, 2024

Drift has shaped a number of strategic partnerships. For instance, Ondo Finance integrates real-world belongings into Solana DeFi utilizing tokenized treasury payments as collateral. Moreover, Circuit Buying and selling introduces Market Maker Vaults on Drift, permitting customers to make the most of superior market-making methods.

Drift goals to supply a capital-efficient buying and selling platform whereas guaranteeing asset safety. It helps various incomes alternatives and gives sturdy instruments for builders. Consequently, its strategic partnerships additional improve its capabilities within the decentralized finance ecosystem.

2. BounceBit (BB)

BounceBit is creating a BTC restaking infrastructure to supply a foundational layer for numerous restaking merchandise. This method, secured by the regulated custody of Mainnet Digital and Ceffu, showcases a Proof-of-Stake Layer 1 community throughout the BounceBit ecosystem.

It makes use of a dual-token system the place validators stake BTC and BounceBit’s native token, combining native Bitcoin safety with full EVM compatibility. Furthermore, important infrastructure, similar to bridges and oracles, is secured by restaked BTC. By integrating CeFi and DeFi frameworks, BounceBit permits BTC holders to earn yield throughout a number of networks.

BounceBit has actively partnered with a number of key gamers to reinforce its choices. For example, with PolyhedraZK, BounceBit will combine zkBridge and the Bitcoin Messaging & Token Swap protocol, which is anticipated to speed up liquidity progress. This integration will facilitate the trustless bridging of belongings to and from BounceBit, benefiting customers by enhancing asset mobility.

As well as, the partnership with fafafa_io focuses on unlocking yield alternatives by the Telegram app, notably in USDT. This collaboration goals to simplify entry to yield technology throughout the Telegram platform.

The partnership with @doubler_pro will deliver a unique approach to strategic yield on BounceBit.

Doubler is an asset yield rights separation protocol. It captures returns through martingale technique & distributes returns primarily based on tokenized yield rights.

Anticipate extra particulars quickly. https://t.co/cvC3o52cUM pic.twitter.com/Zyl4CtfV0b

— BounceBit (@bounce_bit) July 19, 2024

Moreover, BounceBit has shaped a strategic alliance with Block Imaginative and prescient, a number one infrastructure supplier in each the Transfer and EVM ecosystems. Blockvisionhq will contribute by creating the BBScan explorer and providing node, validator, and indexing companies, thus strengthening BounceBit’s infrastructure.

Lastly, the collaboration with doubler_pro introduces a novel strategy to strategic yield on BounceBit. These partnerships exhibit BounceBit’s dedication to actively enhancing its infrastructure and offering modern options for yield technology and asset mobility.

3. Venom (VENOM)

The Venom blockchain addresses key points that hinder the widespread adoption of decentralized purposes, similar to gradual transaction confirmations, excessive charges, and restricted scalability. Its design goals to enhance person expertise and allow broader use.

One main problem for blockchain know-how is processing a excessive quantity of transactions per second. That is particularly necessary for public blockchains like Venom, which should concurrently deal with transactions from many customers. Conventional blockchain methods usually need assistance with this demand.

Venom addresses this with its Dynamic Sharding Protocol, which reinforces efficiency by adjusting the community’s construction primarily based on the load. This protocol permits for the splitting or merging of shard chains to extend transaction throughput. Every shard chain handles a particular set of contract addresses and transactions, enabling parallel processing by totally different validator teams.

Moreover, Venom makes use of Workchains, that are specialised blockchains for numerous purposes. This strategy helps horizontal scalability by distributing duties throughout a number of blockchains, every with its validators, thereby bettering general effectivity and transaction pace.

$VENOM/USDT spot buying and selling is now stay on @deepcoin_news, reaching 10 million new customers and increasing our international footprint! 🌏

🔗 Commerce now!https://t.co/2glpaObCCo

Additionally, prepare for the upcoming VENOM/USDT Perpetual buying and selling launch this Wednesday, July seventeenth at 17:00 (UTC+8). 📅 https://t.co/WGPWSCxGZB pic.twitter.com/RGtjHgDBsi

— Venom Basis (@VenomFoundation) July 15, 2024

By way of safety, Venom strongly focuses on decentralization and safety. The blockchain employs the Venom Consensus Protocol, which mixes Proof-of-Stake (PoS) with a Byzantine fault-tolerant algorithm. This setup ensures that the community can obtain consensus even when some members are malicious, thus preserving blockchain integrity.

Rigorous auditing of good contracts can be integral to sustaining safety and belief. Therefore, Venom companions with main audit companies and gives sources for engineers to overview good contract codes. Venom’s partnerships with Choise.ai, KuCoin Ventures, United Community, and Gate Labs purpose to reinforce its ecosystem’s progress and innovation and assist and strengthen Venom’s impression throughout numerous industries and international markets.

4. WienerAI (WAI)

WienerAI ($WAI) market entry seeks to supply crypto buying and selling options by combining synthetic intelligence, AI tokens, and a buying and selling bot. This integration goals to simplify cryptocurrency buying and selling for newcomers by predictive know-how.

Following the undertaking’s launch in mid-April, it raised over $7.5 million, reflecting investor optimism in regards to the potential progress of the WAI token. Regardless of bearish market circumstances, the demand for WAI displays growing curiosity within the undertaking. Importantly, the tokenomics plan, which incentivizes early traders and promotes sustainable improvement, helps this curiosity.

A serious draw for traders is WienerAI’s staking rewards. Through the presale, the platform provided an Annual Proportion Yield (APY) of 146% for staking WAI tokens. This has led to over 7 billion WAI tokens being staked, indicating sturdy investor confidence.

We raised $7.5M! That is your final probability to affix earlier than we launch 🌭🤖 pic.twitter.com/BFbbgVys3o

— WienerAI (@WienerDogAI) July 17, 2024

Furthermore, WienerAI’s concentrate on transparency and safety has earned the belief of the investor group. Apart from, WAI’s technological options additionally improve its attractiveness, notably the AI-driven buying and selling interface, which predicts market actions and gives clear analyses.

As well as, WienerAI permits seamless swaps throughout decentralized exchanges with out charges, aligning with a decentralized philosophy. It additionally gives safety towards Miner Extractable Worth (MEV) bots, guaranteeing safe buying and selling. With its presale ending within the subsequent 9 days, traders can capitalize on the token value of $0.00073 for potential future returns.

Go to WienerAI Presale

Learn Extra

PlayDoge (PLAY) – Latest ICO On BNB Chain

- 2D Digital Doge Pet

- Play To Earn Meme Coin Fusion

- Staking & In-Recreation Token Rewards

- SolidProof Audited – playdoge.io

Be a part of Our Telegram channel to remain updated on breaking information protection

-

Business4 weeks ago

Workers’ Compensation Rates: What Businesses Need to Know to Stay Compliant

-

Law2 days ago

Revolutionizing the Ride: How Advanced Technology is Enhancing Motorcycle Safety

-

Health2 days ago

The Intersection of Technology and Trust: Surveillance in Medical Malpractice Cases

-

Crime and Justice2 days ago

The Neuroscience of Injury: How Brain Science is Changing Personal Injury Cases

-

Health2 days ago

Safety First: Examining the Holle Formula for Babies with Allergies