Bitcoin

Top Crypto Gainers Today Jun 26 – Centrifuge, AIOZ Network, Telcoin, JUST

Be a part of Our Telegram channel to remain updated on breaking information protection

The crypto market skilled a notable restoration yesterday, exhibiting positive aspects throughout practically all prime 100 tokens by market cap. Regardless of this upward development, important liquidations totaling over $87 million occurred throughout the previous 24 hours, primarily pushed by $56 million in brief positions, as reported by CoinGlass. Bitcoin (BTC) has risen by 2.45%, reaching $61,983, whereas Ethereum (ETH) elevated by 1.88%, buying and selling at $3,403.

These positive aspects have led to important liquidations, together with roughly $30.9 million in lengthy positions, underscoring the market’s volatility. This restoration comes after a latest decline, with Bitcoin dropping to as little as $59,780 on Monday. Analysts at the moment are monitoring the actions of “accumulation whales,” giant buyers who might capitalize on decrease costs to build up important cryptocurrency belongings.

Greatest Crypto Gainers Immediately – High Checklist

Immediately’s cryptoverse is a mosaic of investor emotions and market actions. With the Concern & Greed Index registering at 46, indicating cautious investor sentiment, the crypto market teeters on the sting. Nonetheless, regardless of this, 62% of cryptocurrencies have surged in worth during the last 24 hours, showcasing pockets of resilience and bullish momentum.

From Centrifuge’s strong 15.21% climb fueled by its revolutionary DeFi options to AIOZ Community’s spectacular 13.54% rise pushed by its cutting-edge Web3 infrastructure. Telcoin additionally noticed a gradual 6.22% enhance, whereas JUST rose 4.37% inside TRON’s DeFi ecosystem. These prime gainers present a dynamic market responding to technological developments and investor optimism.

1. Centrifuge (CFG)

Centrifuge is a decentralized asset financing protocol that connects decentralized finance (DeFi) with real-world belongings (RWA). It goals to decrease capital prices for small and mid-size enterprises (SMEs) and supply buyers with steady revenue. By tokenizing actual belongings as collateral, Centrifuge permits entry to DeFi liquidity by way of Tinlake, a decentralized lending protocol. It makes use of Polkadot for effectivity and cost-effectiveness, integrating with Ethereum to optimize liquidity pathways and assist asset utilization throughout the decentralized ecosystem.

The community’s safety depends on the Polkadot relay chain and a Nominated Proof-of-Stake (NPoS) mechanism. This selects information collators for processing and securely storing community information, guaranteeing excessive safety and resilience in opposition to censorship.

Centrifuge’s native token, CFG, offers liquidity, rewards buyers, and facilitates the conversion of RWA into NFTs by Tinlake. Moreover, the token is crucial for transaction charges and incentivizing community participation.

With rising sentiment round tokenization, an RWA index is an effective way for buyers to achieve publicity to this asset class.

There is not any higher duo to drag this off than @indexcoop and @_Fortunafi.

We’re excited to be part of it! https://t.co/YNRtANZSCd

— Centrifuge (@centrifuge) June 19, 2024

Presently valued at $0.553651, CFG has jumped 15.21% previously 24 hours. Regardless of this surge, the gainer has low liquidity, with a volume-to-market cap ratio of 0.0047. The 14-day RSI is at 55.18, indicating impartial circumstances, and the token has had 10 inexperienced days within the final 30, representing 33% of the month.

The worth volatility over the previous 30 days is low at 16%, and Centrifuge is buying and selling 42.09% above its 200-day SMA of $0.38884. Over the previous 12 months, the token’s value has doubled, rising by 100% and outpaced 61% of the highest 100 crypto belongings.

2. AIOZ Community (AIOZ)

AIOZ Community is a complete infrastructure resolution for Web3 storage, decentralized AI computation, dwell streaming, and video on demand (VOD). It leverages blockchain know-how and peer-to-peer (P2P) networking to supply environment friendly, scalable, and decentralized companies.

The platform goals to deal with the rising demand for dependable and safe digital content material supply, which legacy infrastructures wrestle to satisfy. By using a community of AIOZ Edge Nodes, the platform ensures safe content material supply and incentivizes individuals with $AIOZ tokens.

AIOZ Blockchain combines Cosmos’s robustness with compatibility with the Ethereum Digital Machine (EVM). It makes use of the Tendermint core and a delegated Proof of Stake (dBFT) consensus mechanism to supply excessive transaction throughput, velocity, and scalability with minimal charges. This multichain construction integrates seamlessly with different EVM and Cosmos-based chains, enabling fluid asset and information switch throughout completely different blockchain ecosystems.

$AIOZ buying and selling is now dwell @bitfinex:https://t.co/yqogJ26oj5

Particular Buying and selling charges for $AIOZ:

▪️ No charges for makers

▪️ 4 bps charges for takers

Discover @AIOZNetwork in #Bitfinex weblog:https://t.co/5fbXhrMHN3$AIOZ https://t.co/2A3JufvbcM

— AIOZ Community (@AIOZNetwork) June 13, 2024

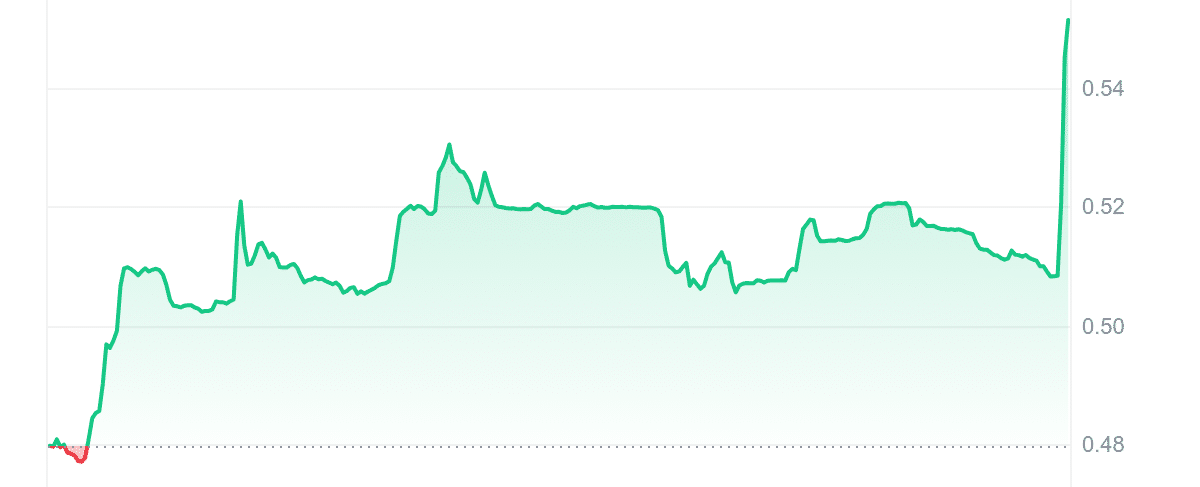

AIOZ is at the moment at $0.494788, up 13.54% within the final 24 hours. It has medium liquidity, indicated by a volume-to-market cap ratio of 0.0168. The 14-day RSI, at 48.22, suggests a impartial stance, implying potential sideways buying and selling. Over the previous 30 days, the token has had 8 inexperienced days (27%), indicating a difficult interval.

Nonetheless, its 30-day volatility is low at 18%, indicating lowered value fluctuations. Impressively, AIOZ Community is buying and selling 1,079.34% above its 200-day SMA of $0.041955. Additionally, over the previous 12 months, the token has surged by 3,416%, outperforming 97% of the highest 100 crypto belongings by market cap.

3. WienerAI (WAI)

WienerAI has reached a major milestone by surpassing $6 million in its presale. This achievement solidifies its function as a number one AI-driven meme coin within the crypto market. The challenge blends superior know-how with a whimsical wiener canine mascot, simplifying crypto buying and selling. At its core is an AI-powered buying and selling bot that navigates market complexities, providing optimized alternatives and insightful evaluation.

Do not be the one chasing your tail! 🐾

That is your probability to get into WienerAI earlier than takeoff! 🌭🚀💰 pic.twitter.com/aSYEYDYPD3

— WienerAI (@WienerDogAI) June 25, 2024

The AI and crypto sectors are experiencing strong development, with AI applied sciences projected to achieve a $1.3 trillion market within the subsequent decade. WienerAI stands out throughout the AI-themed cryptocurrency area of interest, valued at $32.86 billion. Its intuitive platform empowers merchants with predictive instruments and an easy interface, eliminating the necessity for in depth technical experience.

Throughout this presale, WienerAI tokens are priced attractively at $0.00072 every, providing early buyers an advantageous entry level. This strategic pricing units the stage for potential appreciation post-listing on a serious trade, enhancing WienerAI’s visibility and liquidity and boosting investor confidence within the challenge.

With 20% of its token provide allotted to staking, yielding a aggressive 190% APY, WienerAI goals for sustained development and early adopter rewards. The momentum of WienerAI’s presale underscores its emergence as a pacesetter in AI-driven crypto, poised for continued enlargement and innovation.

Go to Wienerai Presale

4. Telcoin (TEL)

Telcoin is the native medium of trade, reserve asset, and protocol token of the Telcoin user-owned, decentralized monetary platform. It permits finish customers to seamlessly entry and energy a world suite of user-owned, decentralized monetary merchandise. TEL incentives coordinate market individuals, similar to telecoms and energetic customers, to supply value-added companies to finish customers. The aim is to supply each cell phone person globally quick, inexpensive, user-owned monetary merchandise.

Its launch product, Telcoin Remittances, affords high-speed, low-cost digital cash transfers to cellular cash platforms and e-wallets globally. The platform operates on the Ethereum blockchain, with TEL being an ERC-20 token. Safety is enhanced by a 2-for-3 multi-signature Ethereum pockets, permitting customers to retailer and transact belongings with out complicated personal key administration.

When’s the final time you set foot in a financial institution? What number of hours a day do you spend in your cellphone?

As our lives change into more and more digital, #Telcoin acknowledges that monetary companies ought to mirror fashionable life and elevated entry to the web. pic.twitter.com/ras348F1lg

— Telcoin (@telcoin) June 25, 2024

The present value of Telcoin is $0.002646, reflecting a 6.22% enhance within the final 24 hours. Regardless of having low liquidity, with a volume-to-market cap ratio of 0.0022, Telcoin’s market cap stands at $233.28M, with a 24-hour buying and selling quantity of $516,206. The 14-day RSI is 54.75, indicating impartial momentum. Over the previous 30 days, Telcoin has seen 12 inexperienced days, making up 40% of the interval.

Telcoin’s 30-day volatility is comparatively low at 14%, buying and selling 47.92% above its 200-day SMA of $0.001789. Over the previous 12 months, Telcoin’s value has elevated by 80%, outperforming 51% of the highest 100 crypto belongings by market cap. This constant efficiency highlights Telcoin’s potential as a steady and promising crypto asset.

5. JUST (JST)

JUST operates as a DeFi ecosystem on the TRON blockchain, offering interconnected merchandise to reinforce monetary accessibility and utility. It focuses on its flagship product, JustStable—a decentralized multi-collateral stablecoin lending platform. This platform permits customers to collateralize belongings like TRON (TRX) to mint USDJ stablecoins by way of collateralized debt positions (CDPs) pegged to the US greenback (USD). USDJ serves numerous roles throughout the ecosystem, facilitating transactions and enabling governance participation.

Past JustStable, JUST expands its choices with JustLend, a TRON-powered cash market protocol enabling liquidity provision and low-interest cryptocurrency loans. JustSwap is an automatic market maker (AMM) platform for trustless TRC-20 token swaps. It enhances buying and selling effectivity and liquidity on the TRON blockchain by facilitating the creation of liquidity swimming pools.

TRON’s delegated proof-of-stake (dPOS) consensus mechanism bolsters the community’s safety. Inside this framework, elected tremendous representatives validate transactions and keep community integrity effectively.

🔥#JustLendDAO is now providing provide APY over 11% for $JST

👉https://t.co/2GyoChYqEN https://t.co/mx0D0r6Tlf

— JUST Basis (@DeFi_JUST) June 25, 2024

JST has demonstrated a gradual value enhance, buying and selling at $0.028719 with a 4.37% rise within the final 24 hours. Its excessive liquidity ratio of 0.0915 and market cap of $284.32 million mirror energetic buying and selling and investor curiosity. The token’s 14-day RSI of fifty.56 signifies impartial market circumstances, suggesting potential sideways motion.

Additionally, its 30-day volatility of 4% additional signifies minimal value fluctuations. Buying and selling above its 200-day SMA by 6.61% and exhibiting a 31% enhance over the previous 12 months, JUST has positioned itself as a steady performer within the DeFi sector.

Learn Extra

PlayDoge (PLAY) – Latest ICO On BNB Chain

- 2D Digital Doge Pet

- Play To Earn Meme Coin Fusion

- Staking & In-Sport Token Rewards

- SolidProof Audited – playdoge.io

Be a part of Our Telegram channel to remain updated on breaking information protection